What is the Meaning of the DC Rate?

DC Rate stands for District Collector Rate, essentially the minimum property valuation price set by provincial governments. These rates serve as benchmarks for calculating taxes like Stamp Duty and Capital Value Tax (CVT) on immovable properties. Simply put, DC rates ensure property transactions are taxed fairly while discouraging under-declaration of property values.

Table of Contents

Toggle

But here’s the catch: DC rates vary significantly depending on factors such as:

- Type of property (residential or commercial)

- Location (urban or rural)

- Size and dimensions of the property

- Revenue circle of the area

For instance, a plot in a bustling urban area will have a higher DC rate compared to one in a rural locality. This variability ensures that taxation aligns with market dynamics.

Why Were DC Rates Introduced?

Historically, Pakistan’s real estate market struggled with issues like under-declared property values and tax evasion. To address this, provincial governments introduced DC rates as a standardized system for calculating taxes. While these rates don’t always reflect actual market prices, they provide a baseline for tax authorities to ensure compliance.

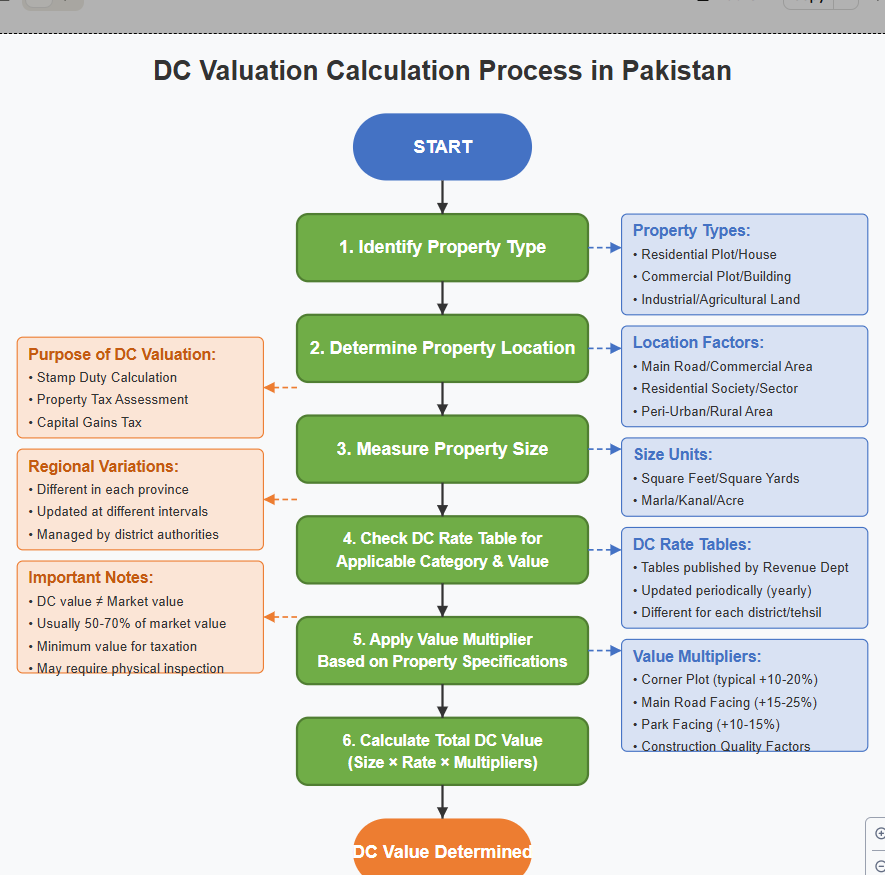

How is DC Property Valuation Calculated?

Calculating DC property valuation involves several steps and factors. Here’s what typically influences the valuation:

- Type of Property: Residential, commercial, or industrial.

- Location: Urban areas generally attract higher rates than rural ones.

- Size and Dimensions: Larger properties naturally have higher valuations.

- Market Dynamics: Demand and supply in specific areas.

- Revenue Circle: The administrative zone governing the property.

For example, under the Stamp Act 1899, stamp duty on rural immovable property is calculated as 3% of the DC rate. These rates are updated periodically by provincial governments to reflect current market conditions.

How Can You Check DC Rates?

To find out the DC rate for your property:

- Visit your provincial revenue department’s website.

- Search for updated valuation tables based on your district and revenue circle.

- Consult local real estate agents for guidance—they often have firsthand knowledge of prevailing rates.

e-Stamping DC Valuation Procedure

The introduction of e-stamping has streamlined property transactions in Pakistan. Through this system:

- Buyers and sellers can access official DC rates online.

- Stamp duties are calculated automatically based on the declared value.

- Transactions become more transparent, reducing chances of fraud.

Step-by-Step Guide to e-Stamping:

- Visit your provincial land record authority’s website (e.g., Punjab Land Records Authority – PLRA).

- Enter property details such as location, type, and size.

- Generate an e-stamp based on the calculated stamp duty.

- Pay stamp duty online or at designated banks.

- Receive an electronic receipt for future reference.

This digital approach has made tax compliance easier for everyone involved—and it’s a game-changer for Pakistan’s real estate sector.

FBR Valuation of Immovable Residential and Commercial Properties Across Pakistan

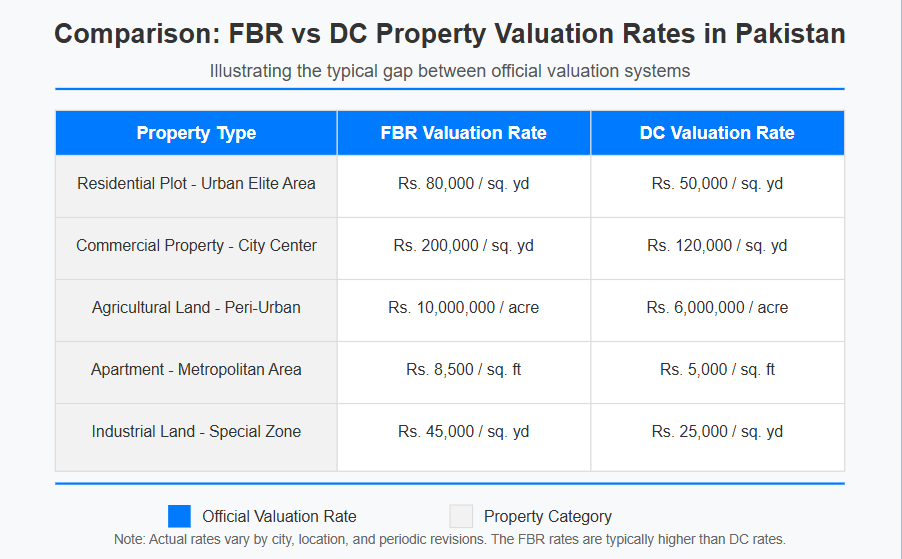

While DC rates are set by provincial governments, the Federal Board of Revenue (FBR) determines property valuations at the federal level for calculating taxes like Withholding Tax and Income Tax. Here’s how FBR rates differ from DC rates:

- FBR rates are generally higher than DC rates.

- FBR valuations consider broader market trends across Pakistan.

- Taxes calculated using FBR rates often result in higher costs for buyers and sellers.

Why Are FBR Rates Higher?

Unlike DC rates, which focus on local benchmarks, FBR valuations aim to capture actual market dynamics nationwide. This ensures that high-value properties in cities like Karachi or Lahore contribute proportionally to tax revenues.

Property DC Valuation in Pakistan

DC valuation plays a crucial role in ensuring fair taxation across provinces like Punjab and Sindh. Each province has its own methodology for setting these rates based on local market conditions.

Punjab

In Punjab, DC valuation is managed by the Punjab Land Records Authority (PLRA). Cities like Lahore, Rawalpindi, and Faisalabad have distinct DC rates that reflect their unique real estate dynamics.

Sindh

Sindh’s real estate market, particularly Karachi, operates under a similar framework but with higher valuations due to its status as an economic hub.

Khyber Pakhtunkhwa (KPK)

In KPK, districts like Peshawar have seen significant revisions in DC rates due to increased urbanization and demand for residential properties.

Difference Between DC Rates & FBR Rate

Understanding the distinction between DC rates and FBR rates is vital:

- Authority: DC rates are set by provincial governments; FBR rates are federal.

- Purpose: DC rates calculate stamp duty; FBR rates determine withholding tax.

- Valuation: FBR rates are typically higher than DC rates.

- Flexibility: DC rates vary by locality; FBR rates apply uniformly across regions.

This dual system ensures that both federal and provincial governments collect their fair share of taxes without overburdening taxpayers.

Importance of DC Property Valuation

Why does all this matter? Here’s why:

- It ensures transparency in property transactions.

- Buyers and sellers can avoid disputes over undervaluation or overvaluation.

- Tax compliance becomes easier with clear benchmarks.

- Investors can assess potential returns more effectively—critical for making smart investment decisions.

Moreover, accurate valuation helps prevent fraud and ensures that government revenues are collected fairly across all regions.

Spotlight: APNA DAFTAR – Affordable Office Spaces Near GT Road

Amidst all this talk about property valuation, let’s take a moment to explore an exciting opportunity for businesses: APNA DAFTAR.

Located in New City Phase 2 Wah Cantt, just 50 steps from GT Road’s main gate, APNA DAFTAR offers:

- Small office spaces at incredibly reasonable prices—perfect for startups or small businesses!

- Free Wi-Fi to keep you connected at all times.

- Complimentary office boy services for day-to-day tasks.

- Access to fully equipped meeting rooms—at no extra cost!

Whether you’re looking to launch a new venture or expand your operations without breaking the bank, APNA DAFTAR combines affordability with functionality in one prime location.

Challenges Associated with DC Valuation

While helpful, relying solely on DC valuation has its drawbacks:

- It doesn’t always reflect actual market prices, leading to discrepancies during transactions.

- Buyers may face unexpected tax liabilities if undervaluation occurs.

- Sellers might struggle to justify their asking price if it significantly exceeds the prevailing DC rate.

To mitigate these challenges:

- Always consult both provincial revenue departments and local real estate agents before finalizing deals.

- Compare DC valuations with FBR assessments for a clearer picture of total costs.

Conclusion

DC valuation isn’t just about numbers—it’s about creating fairness and transparency in Pakistan’s real estate market. Whether you’re buying your dream home or investing in commercial spaces like APNA DAFTAR, understanding these systems can save you time, money, and stress.

So next time you hear someone mention “DC rate,” you’ll know exactly what they mean—and why it matters! With this knowledge in hand, you’re ready to make smarter decisions in Pakistan’s dynamic real estate landscape.